At Investment Locker, our core aim is to serve our clients with dedication and integrity, meet their expectations and build enduring relationship.

Research | Invest | Track

Once you are registered. It takes less than a minute to start a SIP.

"One who fails to plan, plans to fail." so proper planning is required. With the help of our calculators plan your investment needs to achieve your Financial Goals.

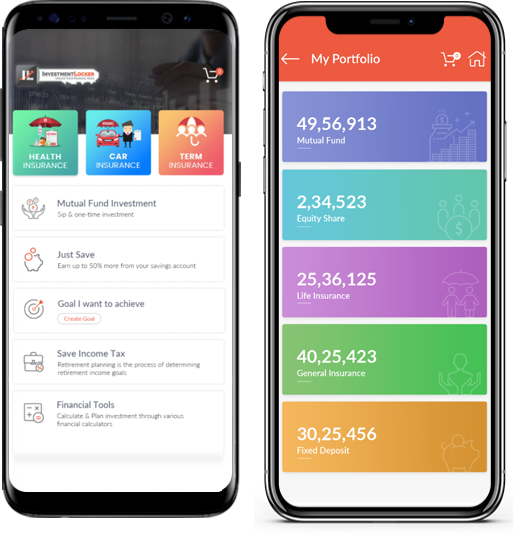

Quick investment at our app, No need to fill the forms every time.

With so many different options, investing with us is simpler

and more straightforward than ever before.

We thank you for the work you have done for us over the past years. The expertise & attention with which you have handled our financial affairs could not be faulted. Your advice on financial planning has saved us significant amount of money. May you prosper along with your clients.

We thank you for the work you have done for us over the past years. The expertise & attention with which you have handled our financial affairs could not be faulted. Your advice on financial planning has saved us significant amount of money. May you prosper along with your clients.

We thank you for the work you have done for us over the past years. The expertise & attention with which you have handled our financial affairs could not be faulted. Your advice on financial planning has saved us significant amount of money. May you prosper along with your clients.

We thank you for the work you have done for us over the past years. The expertise & attention with which you have handled our financial affairs could not be faulted. Your advice on financial planning has saved us significant amount of money. May you prosper along with your clients.

Schedule a meeting with our experts for personalized investment solutions.

Now invest 24*7 in the mutual fund

schemes without any hassles.

© Copyright 2023, All Rights Reserved with Investment Locker. Disclaimer | Disclosure | Privacy Policy